Research Results:RQ3_2021

Simulation of infection spread and control

-

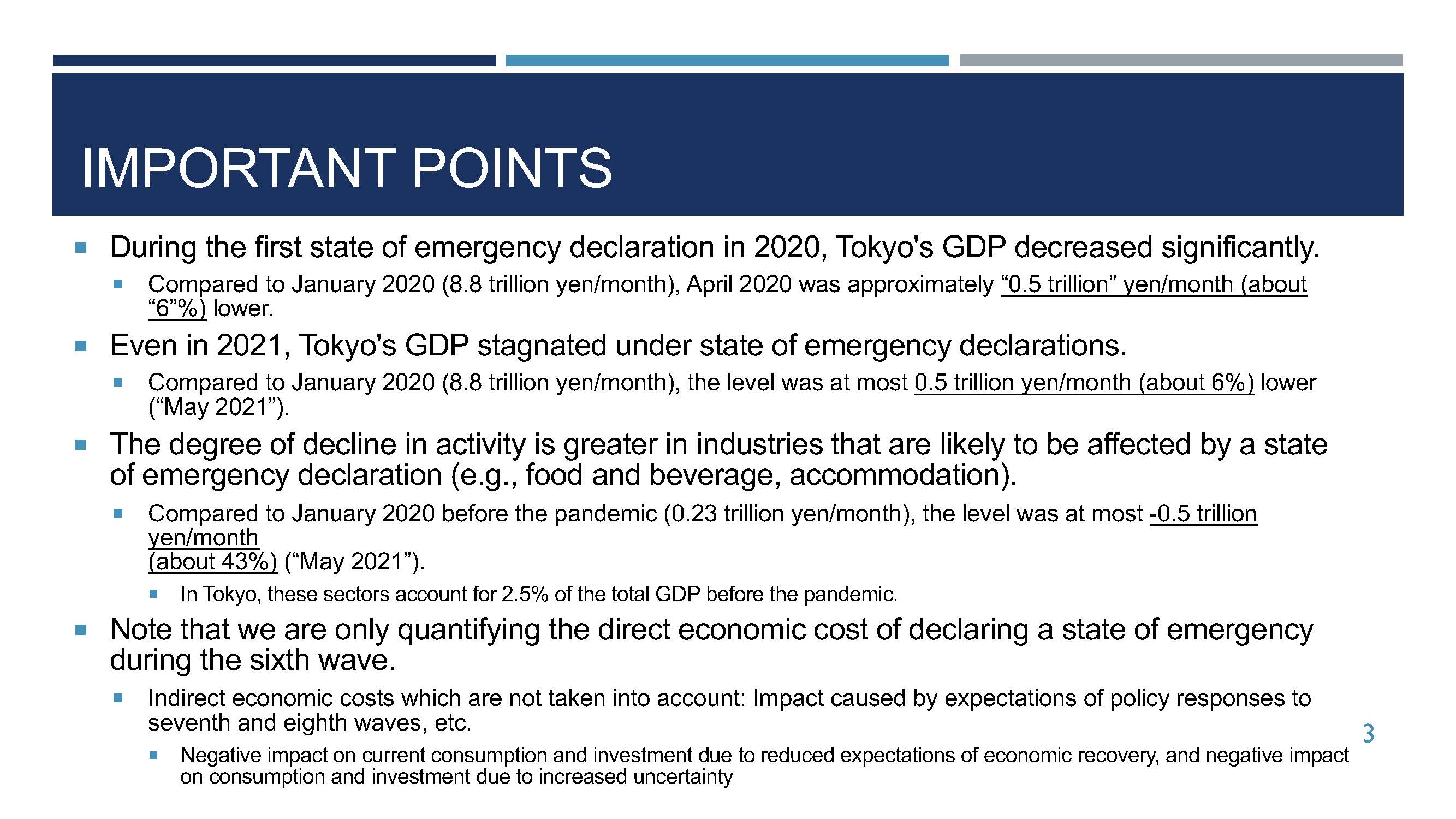

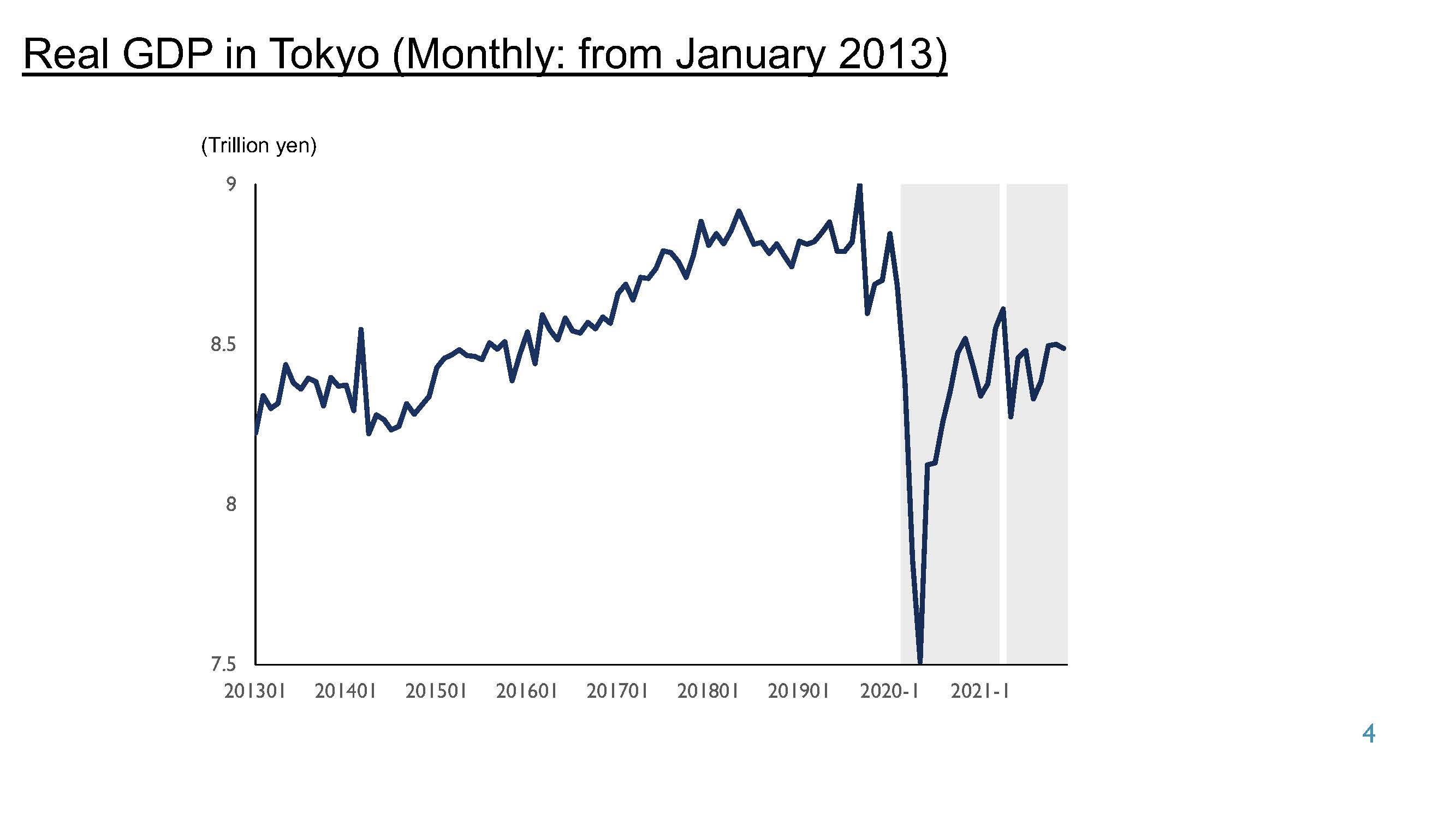

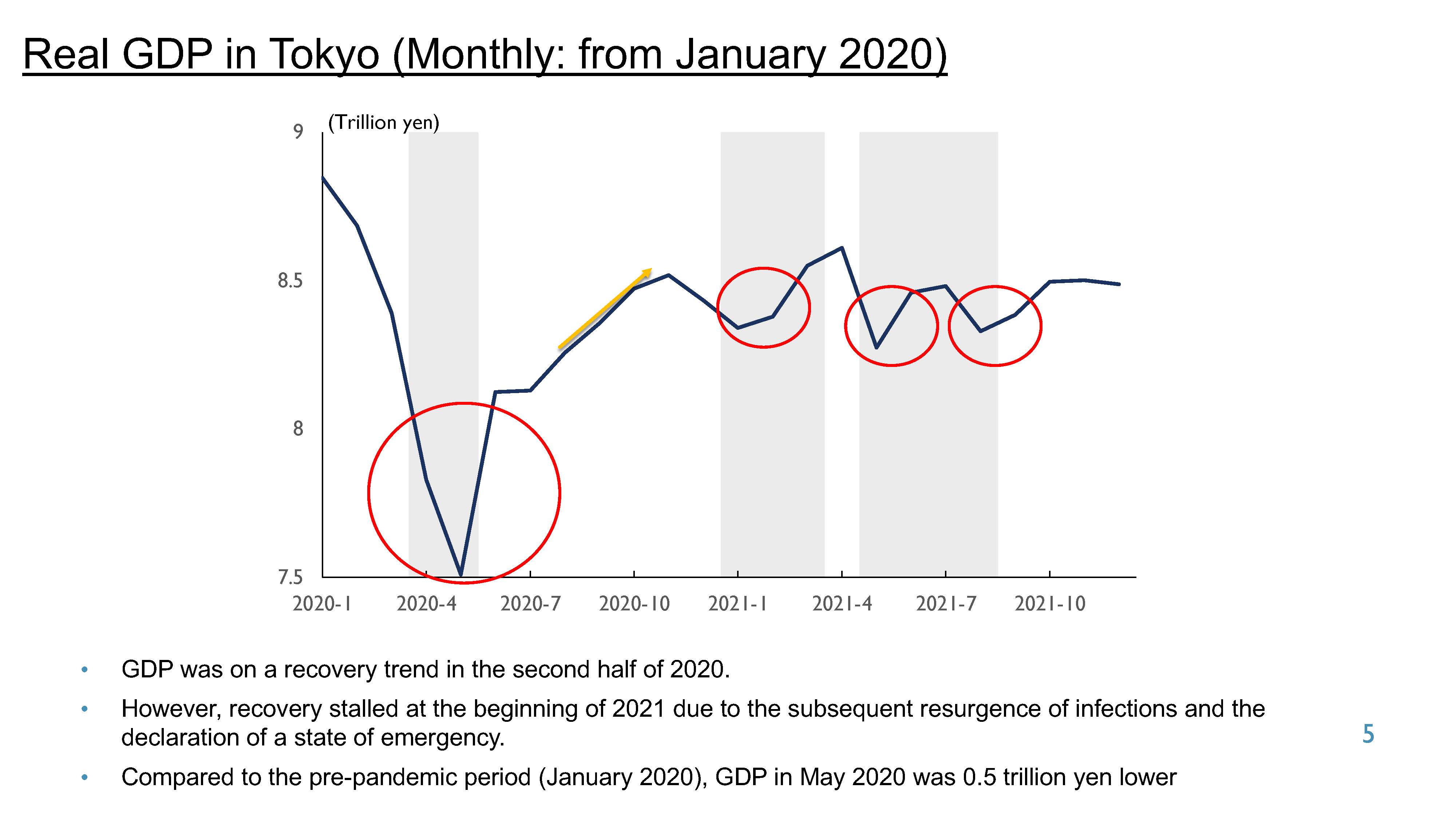

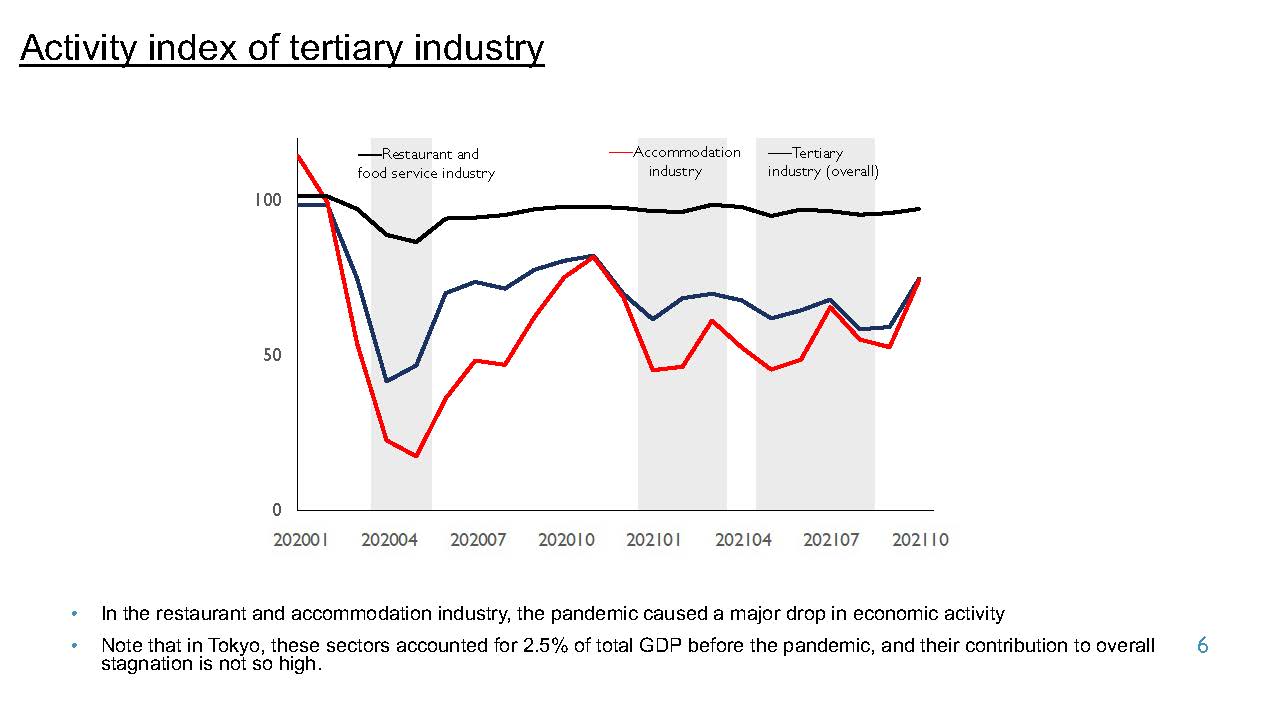

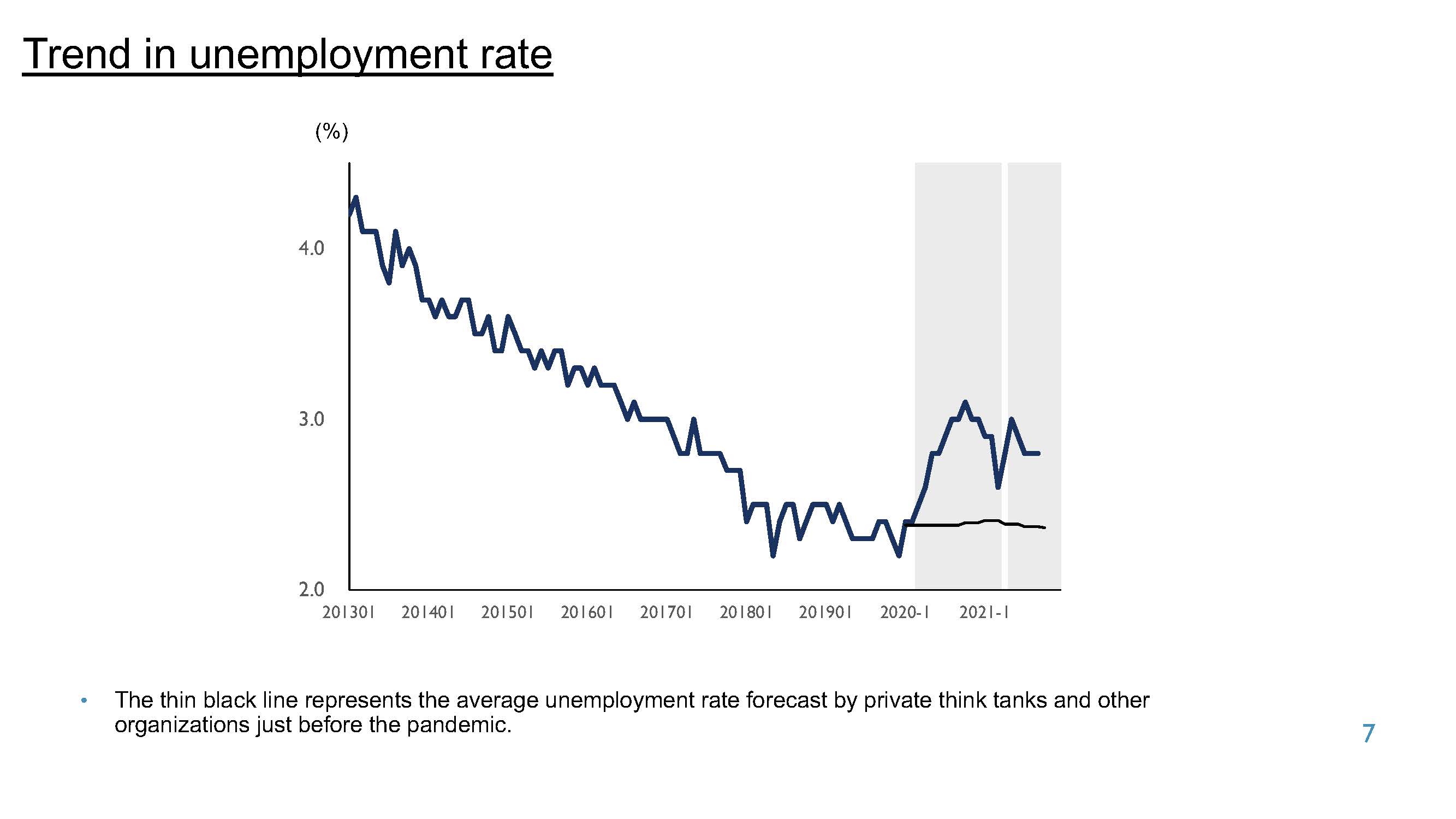

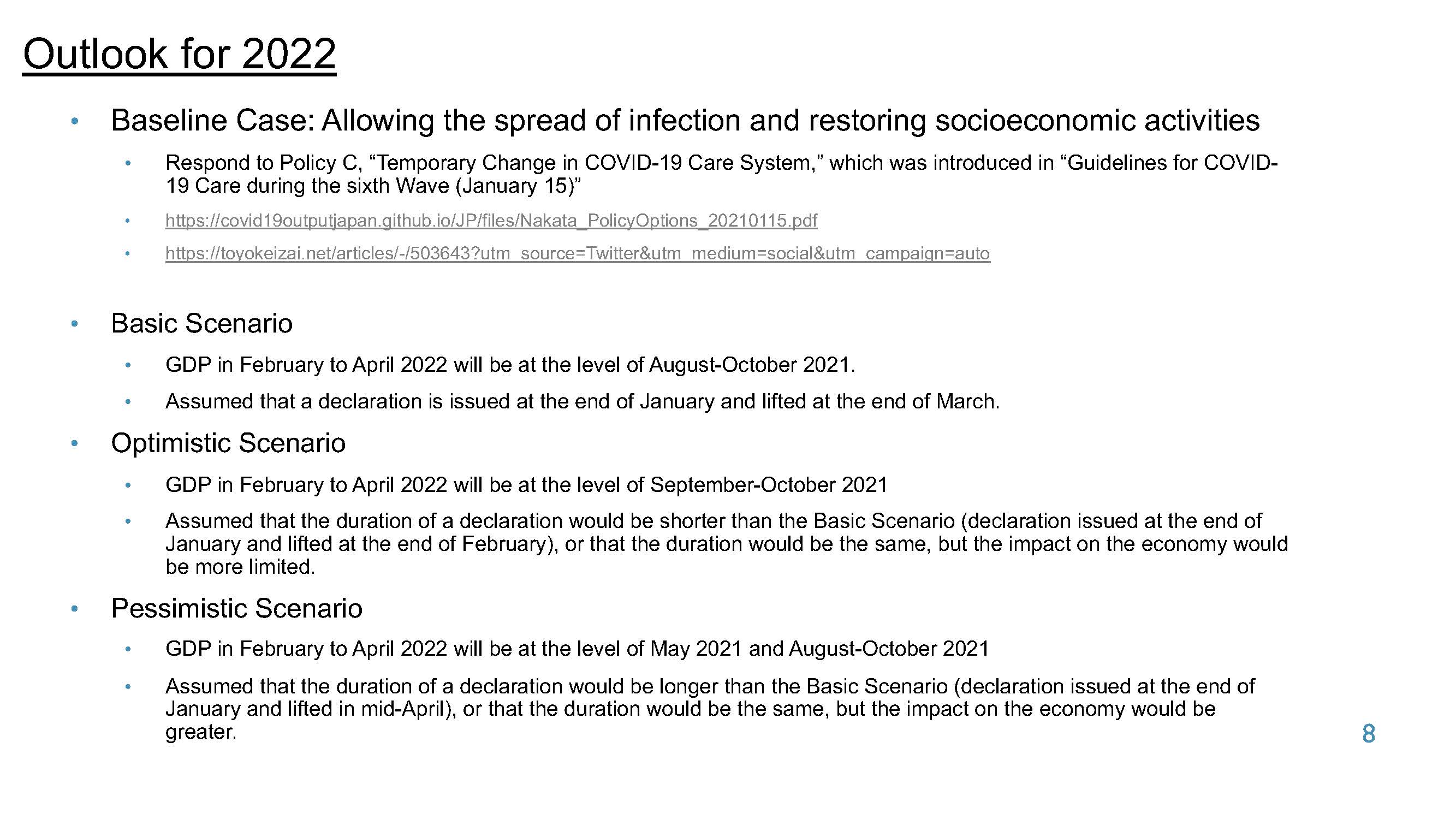

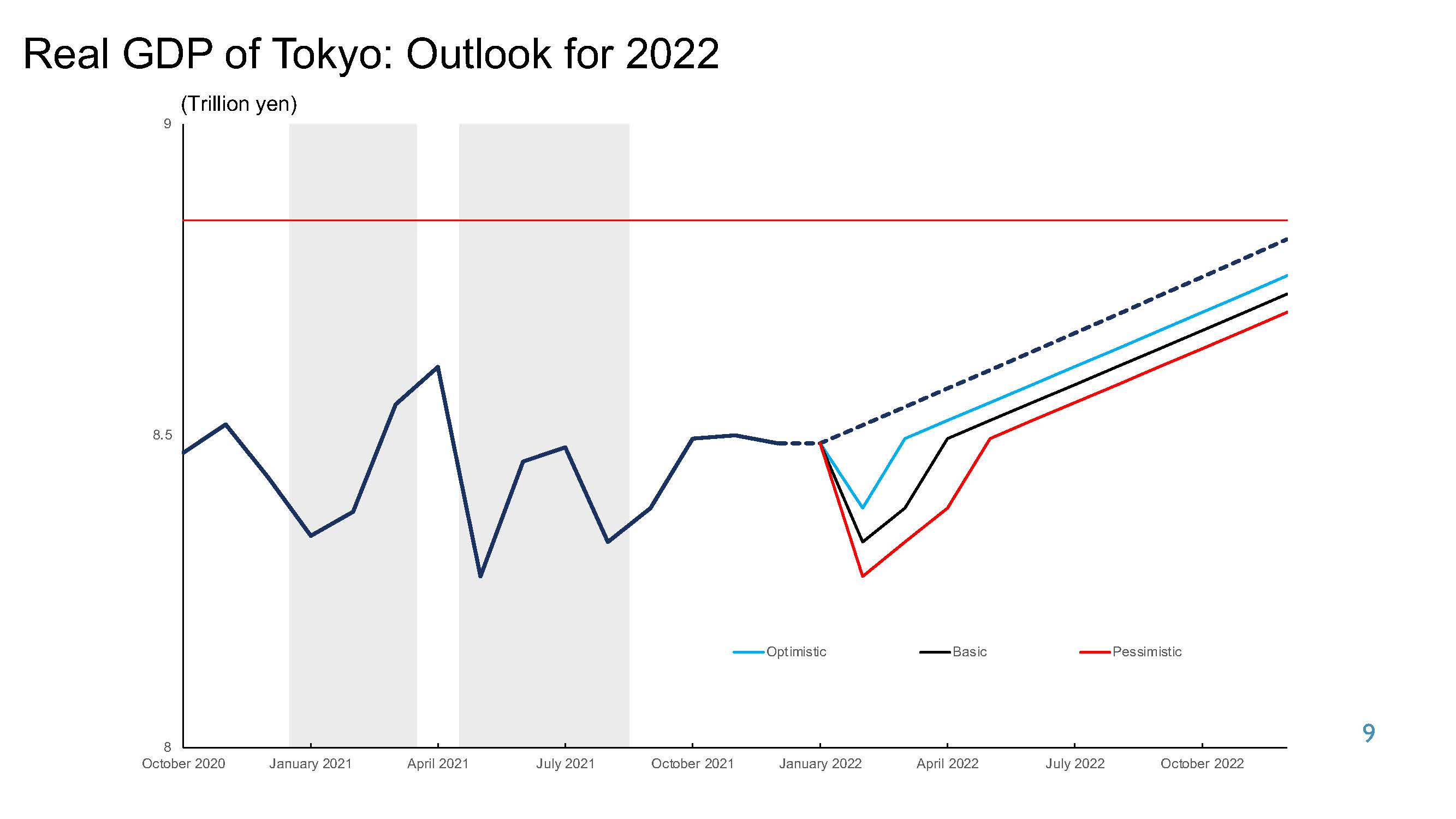

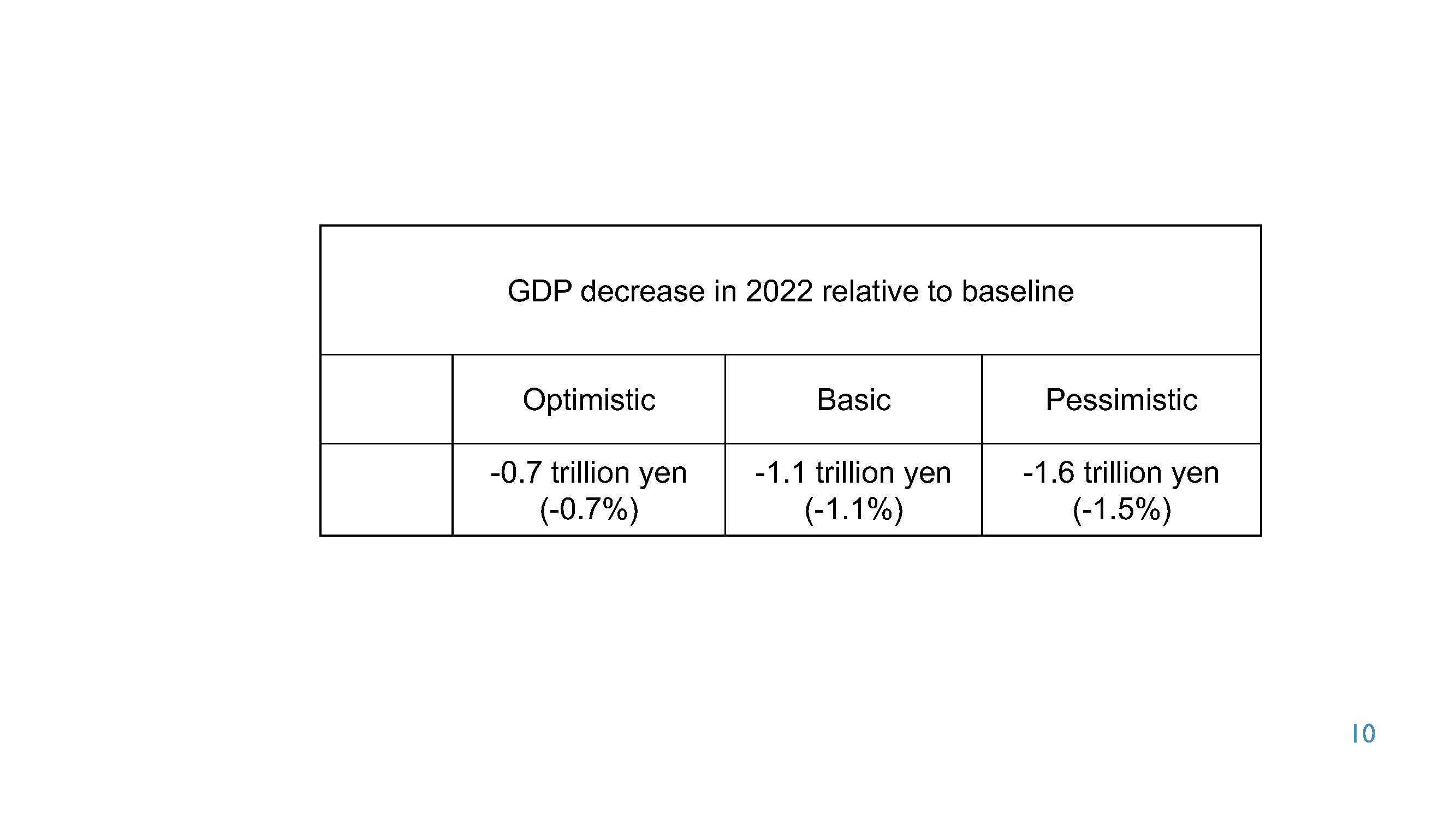

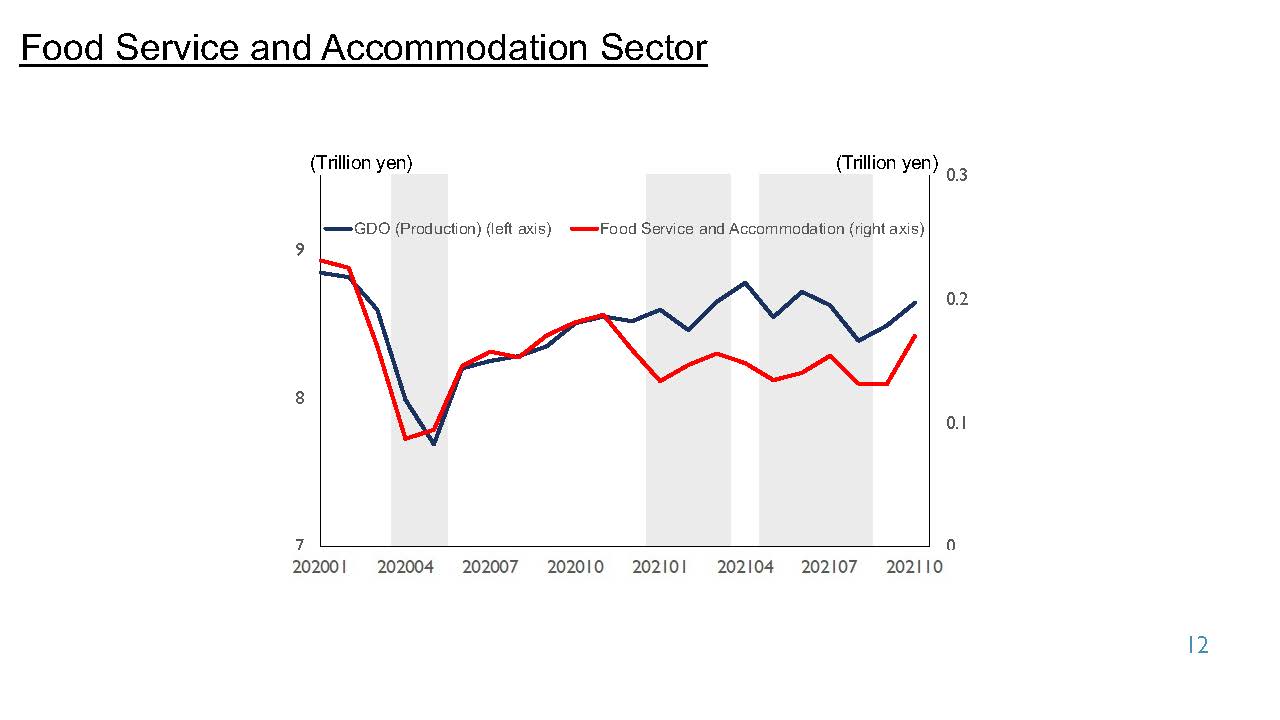

Stagnation of economic activity following the emergency declaration

2022.01.18

Researcher

Taisuke Nakata

Related reports

Researcher

Setsuya Kurahashi

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

No need to be afraid of infection numbers – In the case of the low severity rate scenario #4

2022.03.08

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Divorce rates during COVID-19

2022.03.08

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Akimasa Hirata

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Marriage and birth rates during COVID-19

2022.03.01

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Akimasa Hirata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Setsuya Kurahashi

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Akimasa Hirata

Estimates of the number of daycare closures

2022.02.15

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Akimasa Hirata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Setsuya Kurahashi

Researcher

Taisuke Nakata

Researcher

Taisuke Nakata

Birth rates during COVID-19

2022.02.08

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Marriage rates during COVID-19

2022.02.08

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Tatsuo Unemi

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Researcher

Tatsuo Unemi

Researcher

Akimasa Hirata

Outlook for COVID-19 and Economic Activity – Impact of stricter hospitalization standards #9

2022.01.25

Researcher

Taisuke Nakata

No need to be afraid of infection numbers – Towards post-corona era (low severity scenario)

2022.01.25

Researcher

Yukio Ohsawa

Researcher

Setsuya Kurahashi

Researcher

Setsuya Kurahashi

Researcher

Tatsuo Unemi

Researcher

Setsuya Kurahashi

Researcher

Akimasa Hirata

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Taisuke Nakata

Researcher

Taisuke Nakata

Researcher

Setsuya Kurahashi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Researcher

Akimasa Hirata

Researcher

Akimasa Hirata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Projection of the number of new positive persons assuming the prevalence of Omicron variant

2021.12.21

Researcher

Akimasa Hirata

Researcher

Tatsuo Unemi

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Setsuya Kurahashi

Researcher

Taisuke Nakata

Projection of the number of new positive persons assuming the prevalence of Omicron variant

2021.12.14

Researcher

Akimasa Hirata

Five Reasons for the Decrease in the Number of Infected Persons and Findings for the Future

2021.12.14

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Akimasa Hirata

Researcher

Akimasa Hirata

Researcher

Tatsuo Unemi

Researcher

Akimasa Hirata

Booster Vaccination planning

2021.11.30

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Setsuya Kurahashi

Researcher

Akimasa Hirata

Impact of active domestic travels

2021.11.16

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Setsuya Kurahashi

Revised plan of the new Shimoda Model

2021.11.16

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Akimasa Hirata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Wave Flow in KeyGraph: waves are not over

2021.10.26

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Researcher

Akimasa Hirata

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Researcher

Setsuya Kurahashi

Strategy Cocktail

2021.10.05

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Effect of Antibody Cocktail

2021.10.05

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Akimasa Hirata

Researcher

Akimasa Hirata

“The exit should be opened by someone close to you” – Effect of weeding – “Stay with Your Community”

2021.09.29

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Researcher

Taisuke Nakata

Researcher

Akimasa Hirata

Organization

Mitsubishi research Institute, Inc.

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Taisuke Nakata

Researcher

Akimasa Hirata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Setsuya Kurahashi

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Researcher

Tatsuo Unemi

Researcher

Tatsuo Unemi

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Message from the new model

2021.09.07

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Setsuya Kurahashi

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Researcher

Setsuya Kurahashi

Organization

Mitsubishi research Institute, Inc.

Organization

The Tokyo Foundation for Policy Research

Researcher

Asako Chiba

Progress on MultiLayer-MultiAgent model

2021.08.24

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Researcher

Taisuke Nakata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Organization

Mitsubishi research Institute, Inc.

Researcher

Tatsuo Unemi

Researcher

Akimasa Hirata

Researcher

Taisuke Nakata

Researcher

Tatsuo Unemi

Researcher

Taisuke Nakata

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Researcher

Taisuke Nakata

Researcher

Setsuya Kurahashi

Effect of declining vaccine efficacy

2021.08.03

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Tatsuo Unemi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Taisuke Nakata

Researcher

Setsuya Kurahashi

Researcher

Tatsuo Unemi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Effectiveness of July 12th Emergency Declaration and Accelerated Vaccination Scenario Analysis

2021.07.20

Researcher

Setsuya Kurahashi

Researcher

Setsuya Kurahashi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Organization

Mitsubishi research Institute, Inc.

Researcher

Tatsuo Unemi

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Researcher

Setsuya Kurahashi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Researcher

Setsuya Kurahashi

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Researcher

Tatsuo Unemi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Simulation of Medical and Laboratory Resource Optimization Vaccination Effectiveness Study #4

2021.03.30

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Researcher

Tatumi Yamada

Researcher

Setsuya Kurahashi

Researcher

Setsuya Kurahashi

Organization

The University of Tokyo (School of Engineering)

Researcher

Yukio Ohsawa

Simulation of Medical and Laboratory Resource Optimization Vaccination Effectiveness Study #3

2021.03.23

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Researcher

Tatsuo Unemi

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Researcher

Tatsuo Unemi

Researcher

Setsuya Kurahashi

Simulation of Medical and Laboratory Resource Optimization Vaccination Effectiveness Study #2

2021.03.11

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc

Researcher

Tatsuo Unemi

Organization

Mitsubishi research Institute, Inc.

Researcher

Mitsubishi research Institute, Inc